Effective Health Insurance

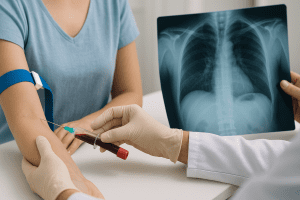

Have you heard of an international student in Perth, Western Australia who was delivering a baby in a hospital? At the end of the student’s stay in the hospital, the hospital handed $84,000 of bill as she had to go through the intense procedure during the delivery. Her delivery demanded experienced surgeons and long time on surgeon’s ward.

Imagine someone like her in Australia on student visa already bearing the expensive course. And on top, a bill that demands 84K? Wait a minute… Imagine her paying the bill for the rest of her lifetime.

Luckily, she didn’t had to pay a penny out of her pocket thus making these new parents out of financial stress. She was complying the condition 8501 of student visa with Australian health insurance provider valid for student visa. It was not a luck or mystery. A compliance towards a visa is a requirement cause there may be a similar situation in front of us somewhere.

Heard of another story of a student who appearred in a motorbike accident and he was also in the similar situation of hefty amount of $49000. Well, he took a helicopter ambulance ride after the accident and a fortnight of stay in hospital would be the fairer price for the hospital. It turns out to be a fairer deal with his insurance company too as he was complying with similar health insurance policy.

Condition 8501 demands visa holders to have a valid health insurance while being in Australia on some visa subclasses. Not complying to the condition is a breach of Australian Immigration Law and also a risk for your well-being.

The insurance policies are widely known to visa holders in two different terms. They are OSHC and OVHC.

OSHC stands for Overseas Student Health Cover which is primarily designed for those staying in student visa. Other fact about the policy is that no-one else apart from student visa intendent can hold this.

OVHC stands for Overseas Visitor Health Cover which is primarily designed for other than student visa holders. These policies are not available to be purchased by Australian permanent residents and citizens. There are various category within the OVHC policy too. One needs to make sure their policy complies with the actual demand of their visa condition. For example, the policy of health insurance for visitor visa is different from Temporary Graduate Visa. However, both these are named as OVHC in Australia.

Thus, it is important to know if your policy complies with the required condition.Since there are plenty of options in the market for insurance, it is difficult to choose one. Few things that may go through your thoughts are:

- Compatible to the visa requirement.

- Access to facilities under the policy.

- Excess Amount on policy

- Cost of policy.

- Maximum benefits

These are the major factors for an insurance seeker while choosing a policy. And not all provide the top level benefits with all these points covered in favor of visa holder. There are few best providers in Australia and we are proud to represent these health insurance providers.

If you are looking for health insurance policy that provides the best outcome to you on reasonable price, feel free to contact us. Our friendly team members at Visa Help Services are more than happy to assist you with these services. And on a important note, we provide the best rate without any additional cost on top of insurance fees. Yes, you read that correct. No additional cost other than of insurance. Rather, you may be eligible for freebies or some benefits if the service provider is running such scheme.

Health Insurance in Darwin

Health insurance is more crucial in Darwin especially where the cost of General Practicioner is moderately higher than other parts of Australia. Bearing a cost of insurance may not be a big deal in Darwin as it is similar to all other parts of Australia. Health Insurance in Darwin can be available for all kinds of visa holders. OSHC in Darwin is purchased at the time of student visa application and OVHC in Darwin is purchased at the time of visa application for various other visa subclassess. These subclassess includes 485, 600, 189, 190, 491, and many more. It gives a sense of protection when you have this insurance. Cheap health insurance can be available through us but it may also come up with higher excess fees and less benefit which most of the time is not understood by insurance purchaser.

Contact us for best policy

If you would like to speak with our team member about the cost of insurance and benefit, kindly contact us here. We ensure you will get the market best rate of all.

Site Features

Latest News & Blogs

Tax Deductions

How to lodge an individual tax return

Student Visa – Subclass 500